FIX PROTOCOL

Importance in Modern Trading:

In today’s world of algorithmic and high-frequency trading (HFT), where speed and precision are paramount, the FIX protocol remains a cornerstone of electronic trading infrastructure. Its ability to handle low-latency, high-volume transactions while maintaining consistency and reliability makes it indispensable for market participants.

Overall, FIX continues to play a critical role in fostering connectivity, transparency, and efficiency in global financial markets, supporting the seamless exchange of information across various trading systems and institutions.

My Projects

First is Fun

Throughout my career, I’ve had the opportunity to work on numerous FIX (Financial Information Exchange) projects, each presenting unique challenges and learning experiences. The first project, however, remains particularly memorable.

Twenty years ago, the landscape was vastly different from today’s ultra-low latency, direct-to-exchange trading environment. Back then, the primary goal was simply to ensure orders reached the exchange via FIX. Direct connectivity to exchanges was not common, and many firms relied on third-party vendors to facilitate this access.

Each setup was highly customized, requiring client orders to be modified and re-routed through the vendor before reaching the exchange. Configuring these routes often involved manipulating FIX headers to ensure proper transmission. Unlike today’s race for nanosecond execution times, latency back then was measured in seconds, and achieving milliseconds was considered impressive.

In my first FIX project, I was tasked with designing DMA flow within the existing FIX infrastructure by configuring the FIX headers to route client orders through a vendor to the exchange. This required meticulous attention to detail, as every parameter had to align perfectly for the orders to be processed successfully. This experience laid the foundation for my deep understanding of FIX protocol and complex order routing, which has been invaluable in subsequent projects.

Big Migration

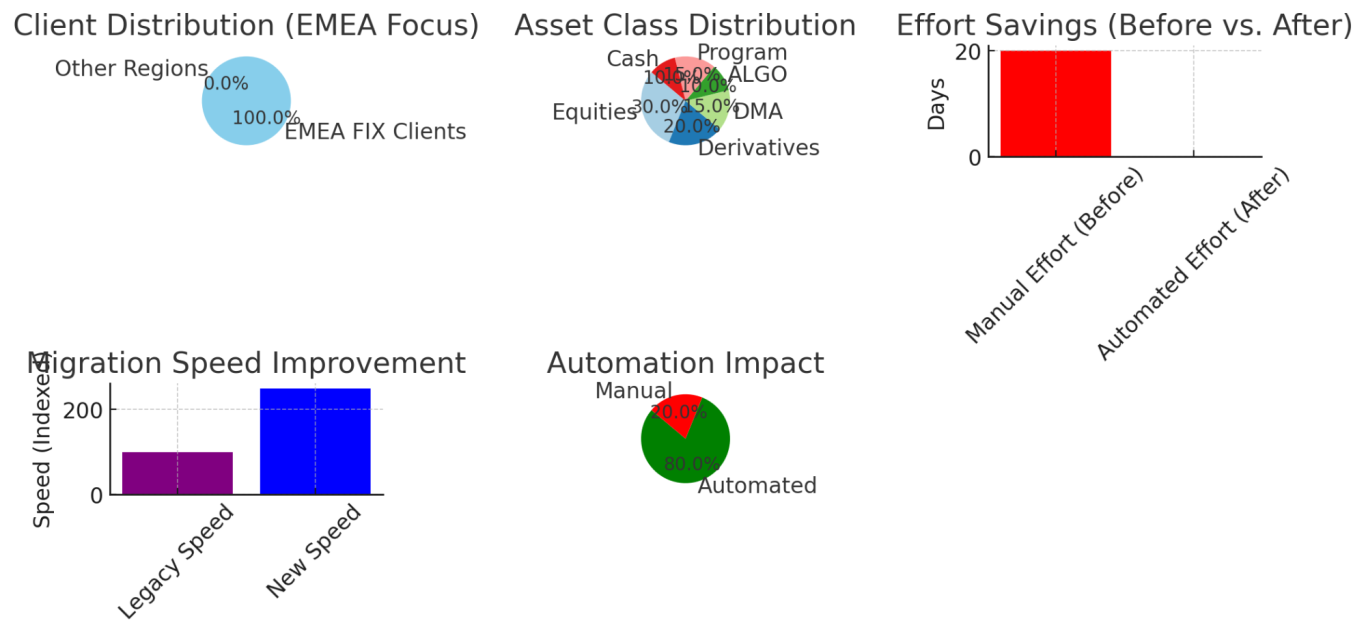

This project involved the migration of over 2,000 EMEA-based FIX clients from a legacy connectivity platform to a next-generation system, including the FIX engine and routing layer. A custom solution was designed to ensure a seamless, invisible transfer of trading flows with zero downtime, accelerating cross-regional migrations by 150%.

Key achievements included:

- Ahead-of-schedule completion: The EMEA migration was finalized 30 days ahead of project tolerance, thanks to thorough analysis and effective project management.

- Automation and efficiency gains: Custom scripts automated the creation of config files, saving approximately 20 days of manual work for 1,000 clients.

- Global onboarding: Successful onboarding of clients for Equities, Derivatives, DMA, ALGO, Program, and Cash trading, ensuring compatibility with the new platform.

- Continuous improvement: Ongoing optimization of routing rules and simplification of complex client workflows, enhancing overall system performance and maintainability.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.